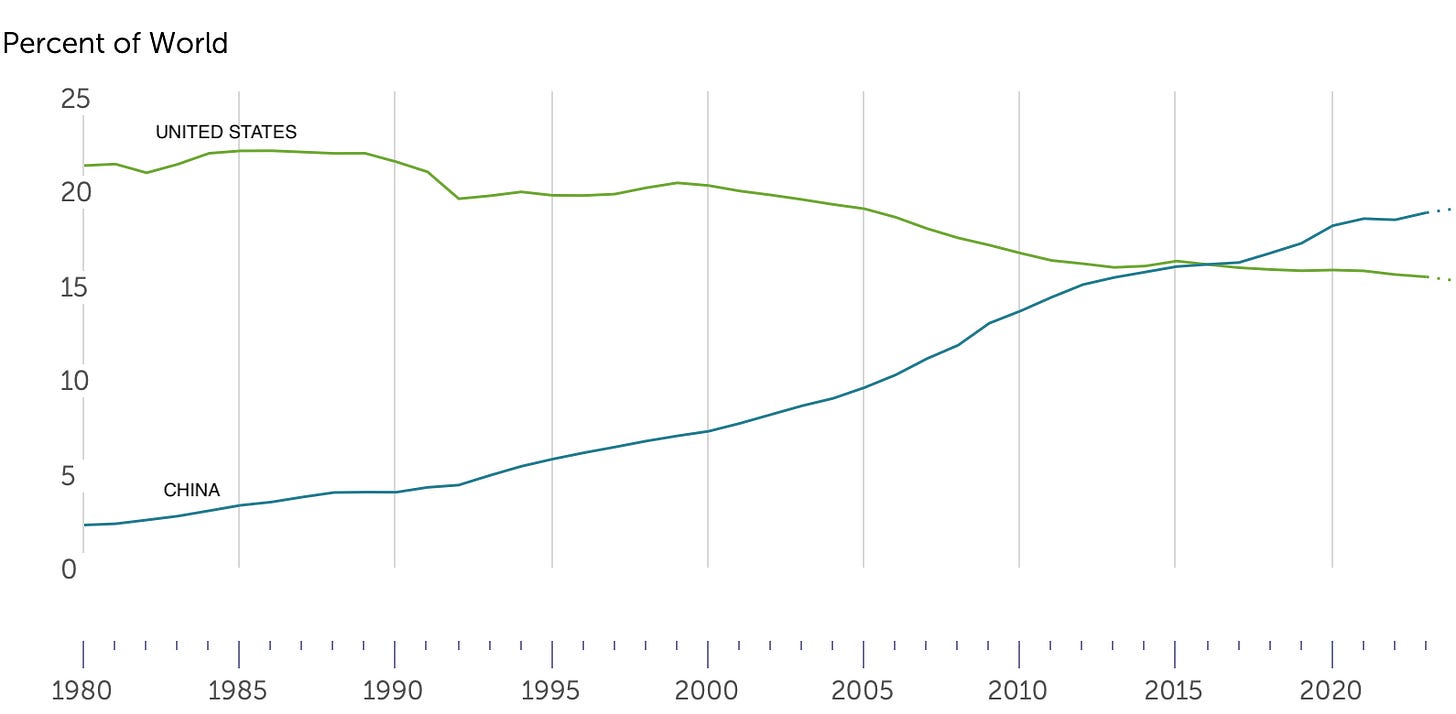

The United States’s share of global GDP has fallen since 2000, as the below chart shows. China, by contrast, has caught up to the U.S., and is now wealthier on a purchasing-power parity (PPP) basis. The share of U.S. dollars in global reserves has also shrunk from 73 percent in 2001 to 58 percent today.

The fact that the U.S. is in decline is clear; what matters is how this will affect investors. In general, as the world changes from one run by a single superpower, like the U.S., to one in which multiple actors set the stage — the U.S., China, Russia, etc. — investors should expect greater market volatility, a reversal of globalization, and bifurcated markets.

In this article, I do the following.

Explain why the U.S. is in decline.

Suggest investment implications.

Conclude, with a teaser for my next article.

If you want to get straight to the investing content, then you can skip the first section.

If you enjoy this newsletter, then please consider subscribing.

Why the U.S. is in decline

Over the past three years, U.S. sovereignty has been fracturing. Yemen-based rebels are using cheap drones to successfully attack U.S.-protected vessels. Saudi Arabia, a longtime U.S. ally, has threatened to accept Chinese yuan instead of dollars for its oil. And in 2021, U.S. troops withdrew from Afghanistan, ceding victory to the Taliban after two decades of war.

Meanwhile, China is on the rise. It has spent over $1 trillion on its Belt and Road Initiative, investing in infrastructure around the world: this includes most of mineral-rich Africa and Central Asia. Its average GDP growth rate over the past decade is 8 percent. Its military is quickly closing the gap with the U.S., and might beat the latter in a confrontation over Taiwan.

How did the U.S. get to this point? The answer lies in the fact that American leaders tried and failed to make the world resemble the United States. They did this through trade agreements, espionage, and wars which stoked nationalist sentiment, engendered anti-American feelings, and allowed for China’s rise.

The Soviet Union collapsed in 1991, leaving the United States as the world’s only superpower. The U.S. enjoyed its status as king for the next thirty years, creating the ‘rules-based international order’ aka American supremacy. Washington sought to maintain its might by spreading U.S.-style democracy to other countries (sometimes violently), reducing trade and migration barriers, and forcing liberal policies onto client states.

This created backlash. Osama bin Laden, the man behind the September 11th terrorist attack, laid out the reasons for his attack in 2002. What follows is a summary of his grievances.

The U.S.’s alleged support for tyrants in Islamic nations.

Washington’s support for atrocities against Muslims in Russia, Iraq, India, Somalia, Lebanon, and Israel.

The moral bankruptcy of America, which it spreads abroad: usury, perversions, drugs, gambling, and the exploitation of women.

Bin Laden also suggested that while American elites claim to support democracy, they have no qualms with overthrowing democratically-elected leaders who oppose The West.

American spies have indeed conducted such coups since 1953, when they toppled the Mossadegh regime in Iran. More recently, there are allegations that the CIA plotted and executed various ‘color revolutions’ in Ukraine, Serbia, and Armenia. And of course, the U.S. engaged in conflicts against Saddam Hussein in Iraq, Muammar Gaddafi in Libya, and Bashar al-Assad in Syria.

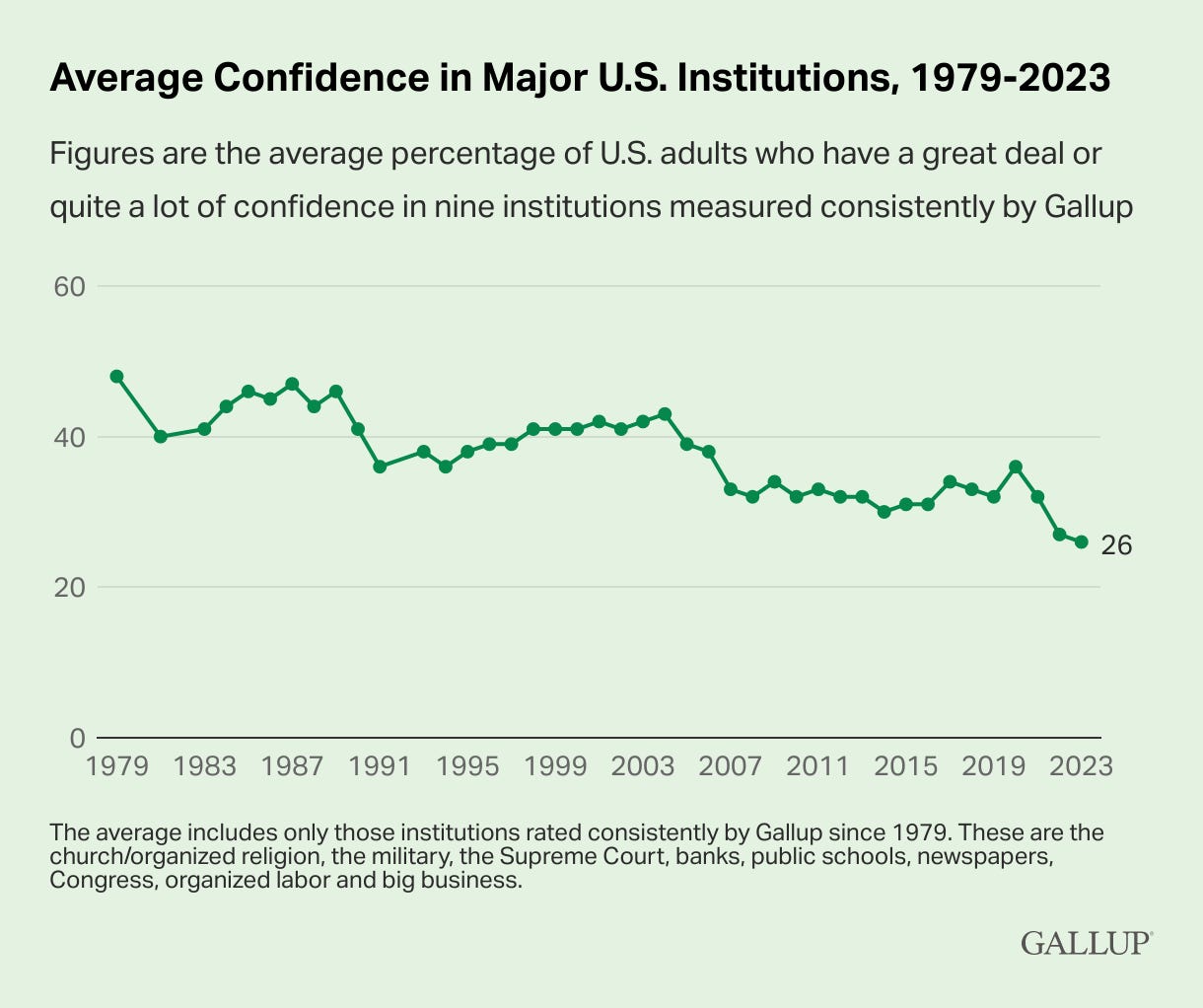

Although he had murdered many civilians, bin Laden’s sentiments were shared worldwide. Hostility to U.S. foreign policy grew, especially in the Middle East, China, and Russia. In 2020, Foreign Policy magazine declared the 21st Century to be ‘anti-American.’ Americans themselves are losing faith in their own institutions.

In the economic sphere, the U.S. bit off its own foot by imposing free trade and open markets on the world. China exploited looser trade conditions to advance its own interests: in particular, boosting exports through subsidized manufacturing and regulated exchange rates. This caused American manufacturing to move from the U.S. to China, thus hollowing out North America’s industrial base. Washington elites tolerated this, assuming that China would turn into a friendly and wealthy yet subservient liberal ally.

That has not happened, and China’s military and economic rise continues to threaten U.S. supremacy. This, combined with growing anti-Americanism, has weakened U.S. dominance on the world stage. Countries which view the U.S. as a bully flee to various Chinese-led initiatives: The Shanghai Cooperation Organization, The Belt and Road Initiative, and the Asian Infrastructure Investment Bank. Since the 2022 military operation in Ukraine, China and Russia have grown increasingly closer.

There are, naturally, processes within the U.S. which are hastening its decline, including a lack of math and science education, political discontent, and uncontrolled migration. However, these are topics for another newsletter issue.

Investment Implications

As the U.S. loses its global leadership position, and the world becomes multipolar, there are a three lessons investors should learn:

Expect greater market volatility.

As the world undergoes abrupt changes, geopolitical risk (GPR) will increase. As GPR rises, so does market volatility. Investors may benefit from trading securities which gain from unexpected fluctuations, such as VIX Index ETFs and straddle options.

Moreover, investors might diversify a portfolio not only across assets, but across the world; emerging market equities may benefit as the world economy turns away from the U.S..Globalization is reversing.

Growing competition between China and the U.S. is causing less support for free trade, and more protectionism. U.S. manufacturing is re-shoring and moving back to the United States.

Expect this to increase the costs of freight and transport. In the hustle to dominate, the U.S. will likely subsidize more manufacturing facilities. These sectors may have excellent upside potential.

Also look out for countries which have remained neutral amidst growing U.S.-China tensions. Apple, for example, is moving some of its production to Vietnam and India.Bifurcated markets may develop.

Currently, commodity markets are globally integrated. For example, world gold prices are determined in London. Regional price differences are quickly arbitraged away.

However, if globalization reverses and countries become increasingly isolationist, placing strict capital controls on each other, then expect arbitrage opportunities to grow significantly for those who can overcome legal hurdles and trade barriers.

In general, commodities may benefit.

Conclusion

The U.S.’s rise and fall parallels that of every great power in history: Ancient Rome, the Byzantines, the Spanish empire, etc. It is a trope that when a country becomes overextended militarily and economically, then its collapse is inevitable.

Unless you are a latter-day Julius Caesar, then there is nothing you can do to prevent this. However, you can protect your family’s wealth. I hope that this newsletter proves useful in this regard, and provides you with some applicable context. I believe that investors who ignore geopolitics over the next decade do so to their own detriment.

In the next post, I will discuss how I would manage a $20 million portfolio (in U.S. dollars, of course!), based on emerging geopolitical trends. This will be a speculative exercise, naturally, but it will help to show you how geopolitics directly impacts investments.

Stay tuned, and thank you for reading. Please subscribe so that you do not miss the latest issue.